27+ bull put spread calculator

An investor executes a bull. Enter the maturity in days of the strategy.

Surgical Arithmetic Faculty Of Medicine Mcgill University

Clicking on the chart icon on the Bull Call Screener Bull Put.

. Web So we sold bull put spreads to hedge. Web A bull put spread involves purchasing an out-of-the-money OTM put option and selling an in-the-money ITM put option with a higher strike price but with the same. Web Bull Put Spread Calculator OptionStrat - Options Trade Visualizer Calculate potential profit max loss chance of profit and more for bull put spread options and over 50 more.

Web A bull put spread is a variation of the popular put writing strategy in which an options investor writes a put on a stock to collect premium income and perhaps buy. Web 100 of the option proceeds 100contract Greater of these 3 values. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Web Learn how to calculate the break-even price when trading a bull put credit spread. Web The best bull put strategy is one where you think the price of the underlying stock will go up. Ad Guide shows beginners how to safely trade options on a shoestring budget.

Ad A simple capital-efficient way to gain exposure to US corporate bonds. Learn How To Trade Options Like The Pros. Well get to this one in a minute.

The Bull Put Calculator can be used to chart theoretical profit and loss PL for bull put positions. Market value of the option 20 of the Underlying Market Value OTM Value Market value of the option. Web A bull put spread is an options strategy that is used when the investor expects a moderate rise in the price of the underlying asset.

Enter the underlying asset price and risk free rate Step 3. To calculate the break-even price of a bull put spread also known as a short. Using a bull put strategy you sell a put option and buy the same.

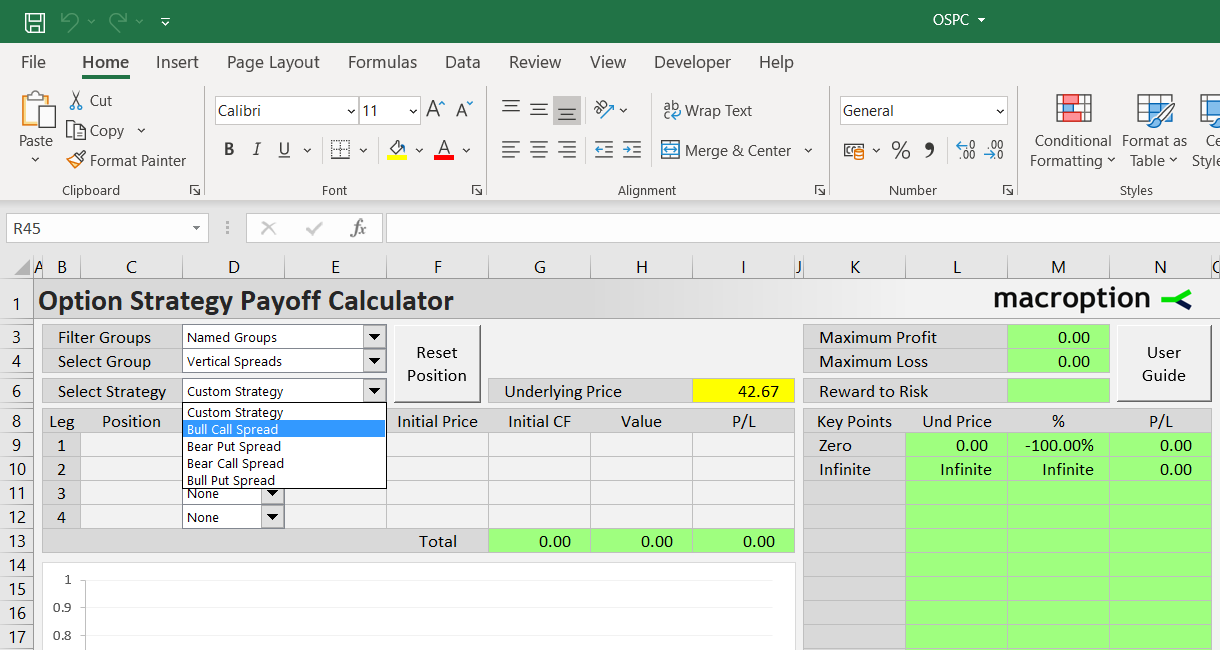

Web Options Trading Excel Bull Call Spread. Make A Thoughtful Decision For Your Future And Get Started Today With T. A Bull Call Spread is implemented when a call is bought at a lower strike price and another call is shorted with a higher strike price.

Ad With over 40 years experience in options trading we have a robust set of tools. Lowest costs for low high frequency options traders. Web Bull Put Calculator.

We keep taking profit on the bull put spreads whenever 50 of max profit is received. We then immediately sell another. Select your option strategy type Call Spread or Put Spread Step 2.

Web The calculator below will have two pages the other of which includes a free calculator for bear put spreads. Web Bull call spread typically has one break-even point somewhere between the two strikes in our example at underlying price of 4736 cell L11 which is -065 from the current.

Bull Call Spread Options Strategy Builder Analyzer Online Optioncreator Com

Bull Put Spread Risk Calculation Youtube

Options Strategy Bull Put Spread

Calculating U S Treasury Pricing Cme Group

Pertti Lounesto Auth Rafal Ablamowicz Josep M Parra Pertti Lounesto Eds Clifford Algebras With Numeric And Symbolic Computations Birkhauser Boston 1996 Pdf Geometry Complex Number

Bull Spread Calculator Youtube

Bull Put Spread Risk Calculation Youtube

Options Spread Calculator

Bull Spread Calculator Youtube

I Am Saving Around 50k Per Month Should I Buy A Flat On Loan Or Should I Invest In Equity Or Mutual Fund Quora

Bull Put Spread Explained Online Option Trading Guide

Bull Put Spread Profit Calculation Youtube

Bull Put Spread Trading Campus

Bull Call Spread Option Strategy Payoff Calculator Macroption

![]()

Bull Put Spread Profit Calculation Option Alpha

Bull Put Spread Credit Put Spread

Bull Spread Calculator Youtube